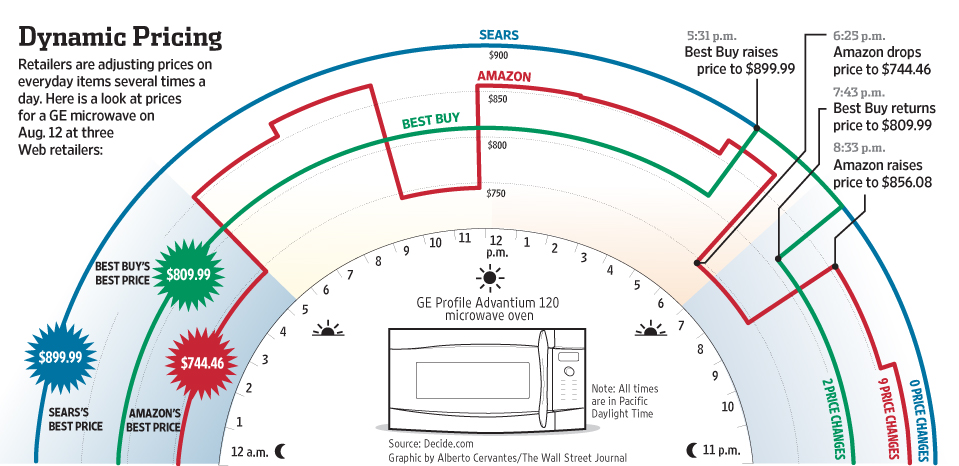

Dynamic pricing: What is the real price of a product?

What is dynamic pricing? Fairly simple to understand this concept, when a retailer (assume seller), keeps changing price of commodity/product with regards to demand and supply (and add a mix of competition, which essentially again translates to demand and supply).

Dynamic pricing is not a new term and existed in the era of pure days physical stores, it started getting visibility and momentum in online world in early half of last decade.

Remember those old days, when you could see same item being sold at slightly different price on the same street, especially during sale days?

With the revised approach to Dynamic pricing, retailers use online channels to monitor prices across the board round the clock and manifest their own prices accordingly. Classic examples of it is when a retailer sees its sales dipping and want to hit sales, at the cost of margins would drop pricing, or if there is surplus stock.

Another element to dynamic pricing is offering prices based on segmentation (User segments) and channels. I.e. a user coming from US may be offered lower prices, vs from EU, so that retailer can start getting footprint in US.

Benefits:

Dynamic Pricing example (img reproduced from WSJ)

Study suggests that pricing intelligence softwares, like web scrapping tools are being used by about 20% or retailers, and is an increasing trend. This offers retailers to be competitive and becomes must for retailers like amazon and ebay who have market place. Retailers can learn a lot about the market trend and in turn implement different price levels and observe price dynamics before finding suitable market price.

Retailer: How do I do it in already existing mix of pricing strategy?

There are primarily 4 pillars and you can mix and match all of these based on your own circustances

- Segmented pricing: Offer users different prices based on which segment you want to target. Segmented pricing is part of almost all the decent ecommerce stack providers. The segments can be based on location of request origination, type of user, also can be offered based on users shopping trend (Low spending customers being shown a lower price)

- Demand pricing: Analyse the demand and supply, then adjust the prices.

- Exploration pricing: At the time when a retailer would like to introduce new product, and with out really knowing what the ideal asking price should be, they can use dynamic pricing.

- Newness Pricing: Item that is relatively new in market is offered at premium price, however something that has been in market and likely to be phased out is offered at lower tier prices. Example of this would be iPhones, like now with iPhone6 in market, market for 4 and 5 has taken hit. Having said that 4 and 5 remains a hit in other geographies when apple does not go soon enough, so segmented pricing is used there.

Concerns?

It sounds all good with dynamic pricing, so there is no drawbacks? This is not entirely true, one of the side effect is brand image, which can take hit if retailer keeps changing prices, in a geography very so often. It also puts puts focus on returns, if prices are dropped too soon, too often, and consumers line up to return items to get again at lower prices.

Ways to implement dynamic pricing?

There are numerous dynamic pricing tools that retailers can use to leverage this, but sometimes they may be costly to implement. So based on a retailers appetite, this can also be easily achieved by offering promotions/ discounts/ coupons.

Is this bad for customers?

It is not entirely bad, if you play it right. yes it does means that there is no fixed / ideal price for an item, all you need is to hunt for deals, and understand the dynamics of product with market to see how/ where you can find the product cheaper. Chirstmas decor will be costly in lineup to Christmas, however as it gets very close to Christmas, prices would go down for same decor. Market gets dull in Jan and any retailer who wants some focus on sales revenue, will offer items for lot cheaper price in January. At the end of the day it also costs a retailer to stock good and not sell it. There is site camelcamelcamel which tracks prices of amazon, and you can use similar price tracking sites to take benefit of drop in prices.

Future?

Dynamic pricing is the future of retail and is going to stay here for years to come. It is a very easy and yet powerful tool for retailers to achieve what matters most~mullah!